Moptions Capital Loans

Moptions Capital is a non-deposit lending institution in Kenya that has been registered under the Companies act and also recognized by the Central Bank of Kenya as a money lending institution. Generally the aim of microfinance banking institutions is to offer loans to businesses and start-ups, which in the long run spurs economic growth and prosperity. Due to the high capital needed to start and maintain a business the microfinance institutions do come in handy. Regulation by the banking sector and the Central Bank is to ensure that the company has enough deposits saved with the Central Bank and they have abided by the banking laws.

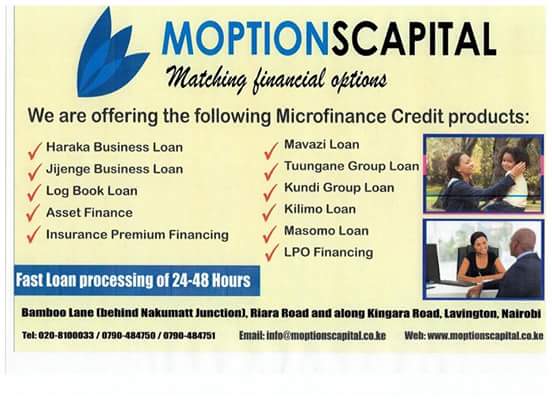

In addition the pillars that govern Moptions Capital include empowerment of the various stakeholders to enable them exploit the opportunities in the various business fields that they wish to invest in. Professionalism and integrity of the company and interaction with the clients is very essential to ensure that there is quality service and value for money.There are different types of loans being offered by the company they vary from business loans, group loans and personal loans. The need to categories the loans in that order is so as to ensure that the regulations are adhered, in the case of business loans one has to present the right rightful documents of the business this includes registration, tax compliance and the reasons for using the loan. Some of the reasons for borrowing the money would be for expansion, increasing the business stock and mechanization.Community loans are largely meant for communal projects which at large will benefit the community rather than individually. In addition communal groups can access the loans for the purpose of the development and creating opportunities in the community this largely includes the women groups.

Personal loans are also advanced for the individual use this includes for acquiring asset, advancing the education levels and also for medical purposes. One needs to show they are in a position to pay back the loan by having a clean credit record.Some of the mandatory requirements of getting the loan includes having a clear record with the credit reference bureau this shows that one has a clean record in paying back their debts.Having an account with Moptions is also necessary for one to qualify for the loans,for one to open an account they need their national identification card and a passport photo.Advantages of taking credit with Moptions Capital include;There are a wide range of trading options these includes asset financing, business jijenge which have a suitable rates in comparison to the needs of the markets and the rates.In the case of personal loans the mode of collateral is quite lenient especially when one has a pay slip.Low interest rate in comparison with other conventional banks which have a set amount of capital to be loaned out.Disadvantages of getting a loan with Moptions Capital;Many documents needed to ensure one has a guarantor to access the funds such as a pay slip and a log book.High interest rates which are unattractive and discouraging the clients.