Payday loans are short term ‘low interest’ loans whereby the person lending the money allocates loans with high interest in-regards to the borrower’s income and credit profile. Payday loans are issued the same day an applicant applies for them. ELIGIBILITY: The following are the qualification necessary to qualify for Payday […]

The onset of technology has brought about so much ease in accessing funds without having to use the conventional banking and SACCOS for one to have access to money and in particular loans. The availability of smartphones and ease of internet accessibility and customer friendly data packages have made it […]

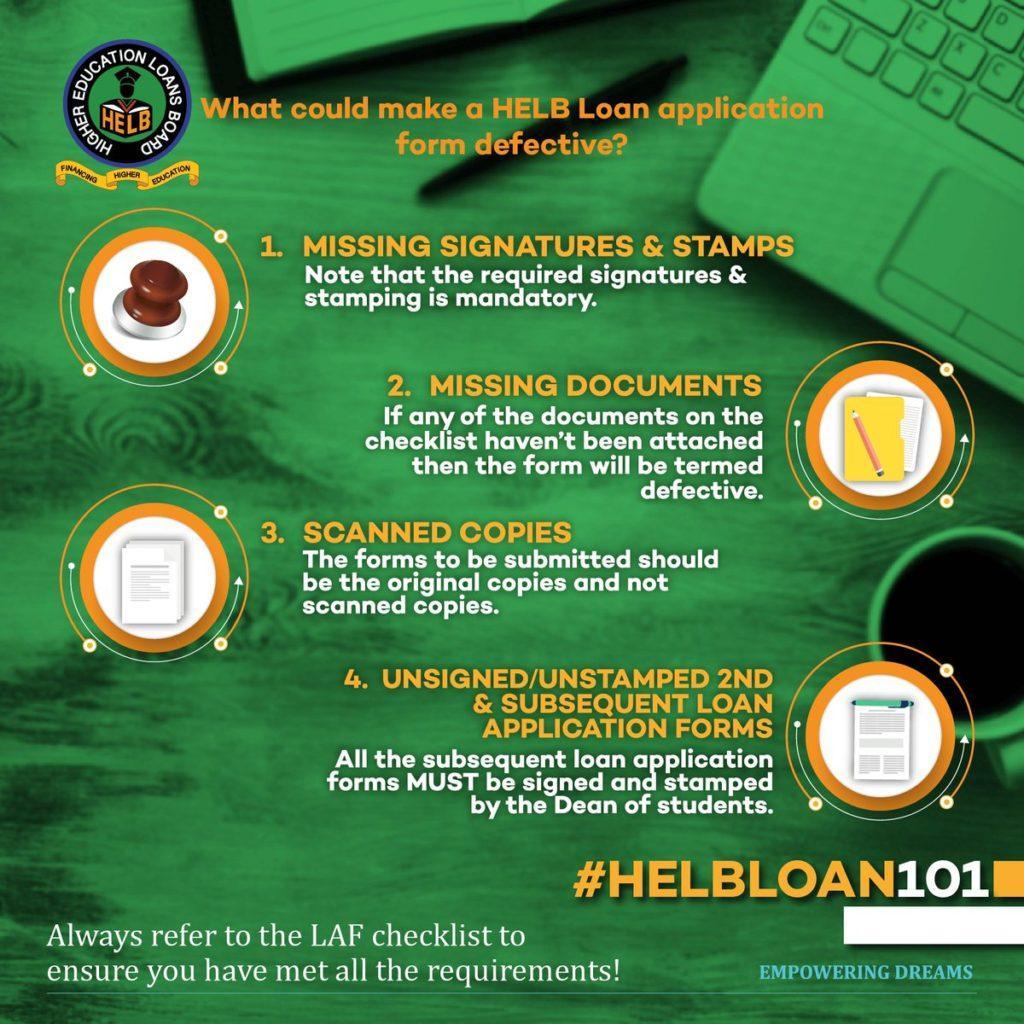

The higher education’s loan board commonly referred to as HELB is an loan disbursement department under the ministry of higher education which is charged with the mandate of providing students with financial assistance so as to make their life in campus more bearable and convenient through meeting the costs incurred while in school.

However, due to the fact that the government is disbursing the HELB to the students.There are a number of conditions which they are supposed to fulfill in order to get the funds, and also for the authorities to prioritize on the neediest students due to the large number of applicants with the loans board. Some of the requirements to qualify for the higher education loan include;

Tvet are initials for Technical, Vocational Education & Training. Tvet loans are issued to eligible applicants that are being enrolled in public Technical, Vocational, Education Training Institutes acknowledged by Ministry of Education.

These are students who are in pursuance of the diploma courses availed in Institutes that have been recognized by Ministry of Education, Science and Technology and have been registered with KUCCPS

VISION:

To be seen as the premier catalyst for workforce development in the region.

BRANCH MOBILE LOAN APP An applicant can acquire as low as Kshs. 250 to highs of 50,000. Branch mobile App can be linked to Facebook and gives loans through the MPESA. The interest on the loan ranges from 1% to 4%. The interest rate becomes better as one continues procuring […]

M-Pesa is a mobile based banking service that allows users to store and transfer money through their mobile phone. M-Pesa was launched by Safaricom and Vodacom in 2007. M-Pesa is a combination of two entities in which M means mobile and Pesa means payment in the Swahili language. The procedure […]