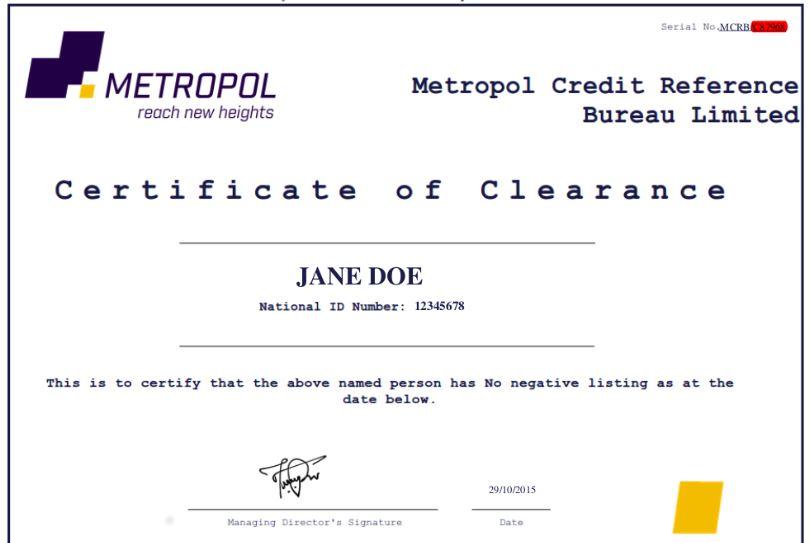

In Kenya, there are three licensed companies by CRB, i.e. TransUnion, Metropol and CreditInfo. Before you can access your status with CRB you need to be registered to one or all of them. Registration to all of them is the recommended way to go. This is because a lender can send the same bad report […]

CRB is an institution licensed to collect, manage and disseminate customer credit information. It collects the customer credit information from all lenders including Saccos, commercial banks and deposit taking micro finances. CRB will then manage the information gathered by regularly updating the customers’ credit scores per their transactions with various financial institutions. When a lender […]

Getting a home loan is a very big commitment as it means that you owe hundred thousand Kenyan shillings to the lender and could take years to repay. Hence, here are some tips that can speed up the process of paying all the money owed back. Choose the right loan Before everything else make sure […]

Taking a loan in Kenya has been made easy in recent years, but don’t be in a rush to get a loan without carefully considering some major issues that determine whether you repay more or less. Interest rates Most people do put interest rates into consideration when they approach a lender, but interest loans alone […]

Acquiring a loan for a small business in Kenya is not an easy task. This is because banks are weary of the risks that small businesses are prone to compared to the large businesses. If you are considering borrowing a loan from a bank for your small business the best move is understand what the […]

If you want to start a small business in Kenya and you are depending on a bank loan for capital, doing research on the bank to get a loan from is a key issue to tackle. Well as you do your own research here are some banks to consider approaching. Jamii Bora bank It offers […]

A bank loan enhances medium or long-term finance. Some kind of security for the loan is a requirement in most cases. Bank loans are very good for financing investments especially fixed assets. The interest charged on a bank loan can be fixed of variable depending on the policies of the bank. Bank loans can prove […]

While having a lot of student loans can be burdensome, there are some upsides of graduating with a bit of debt, especially the one you acquire from the department of education. Sometimes it is absolutely necessary for a student to require some financial help so as to complete his/her education. As a student don’t be so sad about it as there are two sides to every opportunity, the bad and the good.

Interest rate reduction

One of the larger benefits of student loans is that the interest you pay on the loans is often deductible, meaning you can subtract it from your income, reducing your tax burden for the year. The loans offered by the ministry of education in Kenya is deductible once you have finished your schooling and been employed. This ensures you study without much hassle and make payments later once you are employed.

When starting a business, access to finance is a huge consideration for most startups. Applying for a bank loan can be confusing and intimidating, but there are some measures you can take to ensure that your application has a good chance of being accepted. There are many banks in Kenya that offer such like loans […]

Facts you need to know about secured loans in Kenya One of the most popular ways to borrow money in Kenya today is getting a secured loan. Secured loans allow you to borrow the money that you need, and the loan is backed by a property that you as the borrower own. The property can […]