The higher education’s loan board commonly referred to as HELB is an loan disbursement department under the ministry of higher education which is charged with the mandate of providing students with financial assistance so as to make their life in campus more bearable and convenient through meeting the costs incurred while in school.

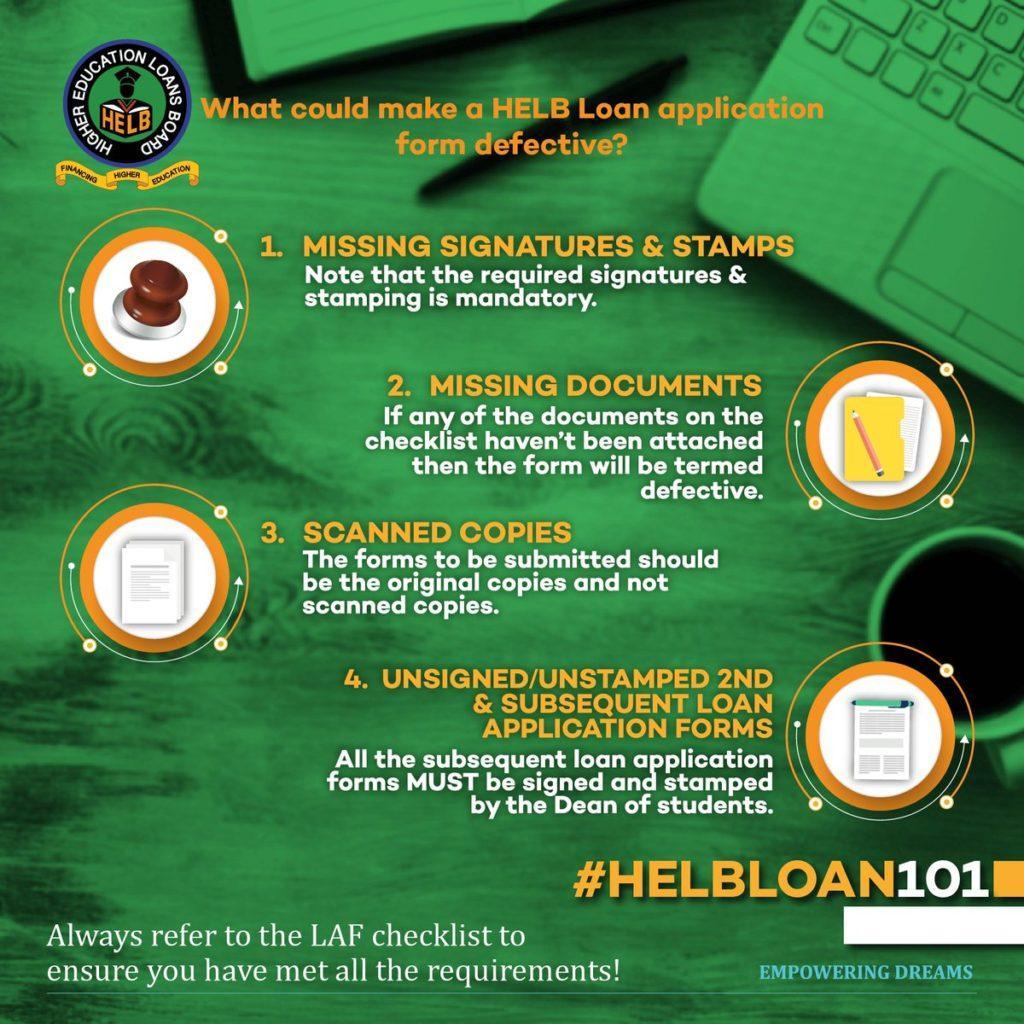

However, due to the fact that the government is disbursing the HELB to the students.There are a number of conditions which they are supposed to fulfill in order to get the funds, and also for the authorities to prioritize on the neediest students due to the large number of applicants with the loans board. Some of the requirements to qualify for the higher education loan include;

Tvet are initials for Technical, Vocational Education & Training. Tvet loans are issued to eligible applicants that are being enrolled in public Technical, Vocational, Education Training Institutes acknowledged by Ministry of Education.

These are students who are in pursuance of the diploma courses availed in Institutes that have been recognized by Ministry of Education, Science and Technology and have been registered with KUCCPS

VISION:

To be seen as the premier catalyst for workforce development in the region.

BRANCH MOBILE LOAN APP An applicant can acquire as low as Kshs. 250 to highs of 50,000. Branch mobile App can be linked to Facebook and gives loans through the MPESA. The interest on the loan ranges from 1% to 4%. The interest rate becomes better as one continues procuring loans and maintaining good credit […]

M-Pesa is a mobile based banking service that allows users to store and transfer money through their mobile phone. M-Pesa was launched by Safaricom and Vodacom in 2007. M-Pesa is a combination of two entities in which M means mobile and Pesa means payment in the Swahili language. The procedure of registering for M-Pesa; Requirements; […]

Information is power, thus knowing your credit report makes be able to use it if necessary. It is thus crucial for you to access your credit report so that you are aware of your current credit reputation. Knowing your standing enables you to make informed credit-related decisions in relation to your personal/business development and growth […]

Tatua Center is an independent office set up to resolve all CRB-related disputes between consumers, lenders and Credit Reference Bureaus (CRB) through Alternative Dispute Resolution (ADR) mechanisms. If you as a consumer have a complaint about your credit report, you should first initiate a dispute at any of the Registered CRBs, after which you can […]

Sometimes you may be blacklisted by CRBs in Kenya wrongly. This may have impacts like, you as a customer will get locked out of borrowing from microfinance institutions, commercial banks and other financial institutions. The following will answer how you as the affected customer can dispute the associated lenders easily and less expensively. The common […]

TransUnion Kenya Personal Information Personal Information Errors Things you need to ensure that are accurate; Wrong name listed Addresses you’ve never lived at or used as a mailing address Inaccurate employer information Ensure that your name is correctly displayed and that any alternative names or alias are accurate. Ensure your year of birth is accurate. […]

The TransUnion CRB services can be accessed through the SMS number 21272, TranUnion Nipashe app and also the TransUnion website. If you choose to register with the TransUnion CRB then the following are the steps you take; Register with TransUnion Send your full names as they appear in your National ID card to 21272 Enter […]

Ever since the financial institutions like Saccos, Banks, HELB and MPESA started forwarding lists of defaulters on CRB, the need for your name to cleared and hence improve your chances of getting a second loan have risen. Clearing your debt is no longer enough as you have to get CRB clearance to regain your borrowing […]