Tatua Center is an independent office set up to resolve all CRB-related disputes between consumers, lenders and Credit Reference Bureaus (CRB) through Alternative Dispute Resolution (ADR) mechanisms. If you as a consumer have a complaint about your credit report, you should first initiate a dispute at any of the Registered […]

Sometimes you may be blacklisted by CRBs in Kenya wrongly. This may have impacts like, you as a customer will get locked out of borrowing from microfinance institutions, commercial banks and other financial institutions. The following will answer how you as the affected customer can dispute the associated lenders easily […]

TransUnion Kenya Personal Information Personal Information Errors Things you need to ensure that are accurate; Wrong name listed Addresses you’ve never lived at or used as a mailing address Inaccurate employer information Ensure that your name is correctly displayed and that any alternative names or alias are accurate. Ensure your […]

The TransUnion CRB services can be accessed through the SMS number 21272, TranUnion Nipashe app and also the TransUnion website. If you choose to register with the TransUnion CRB then the following are the steps you take; Register with TransUnion Send your full names as they appear in your National […]

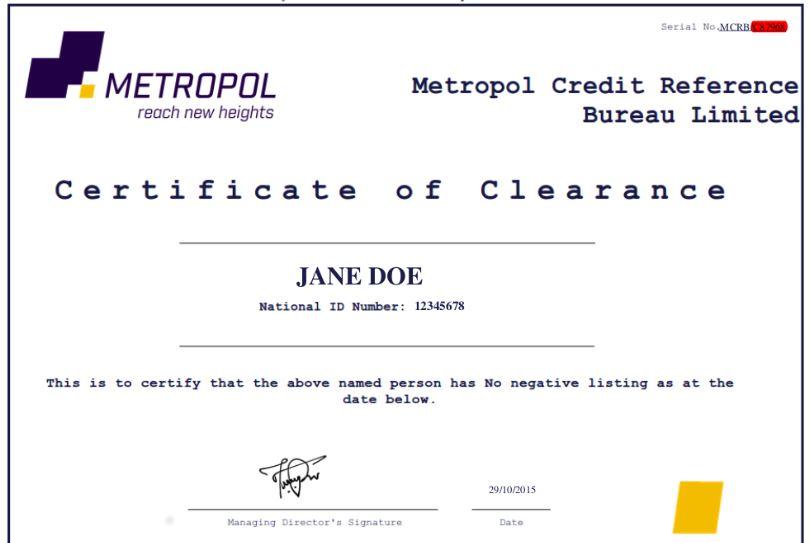

Ever since the financial institutions like Saccos, Banks, HELB and MPESA started forwarding lists of defaulters on CRB, the need for your name to cleared and hence improve your chances of getting a second loan have risen. Clearing your debt is no longer enough as you have to get CRB […]

In Kenya, there are three licensed companies by CRB, i.e. TransUnion, Metropol and CreditInfo. Before you can access your status with CRB you need to be registered to one or all of them. Registration to all of them is the recommended way to go. This is because a lender can […]

CRB is an institution licensed to collect, manage and disseminate customer credit information. It collects the customer credit information from all lenders including Saccos, commercial banks and deposit taking micro finances. CRB will then manage the information gathered by regularly updating the customers’ credit scores per their transactions with various […]

Getting a home loan is a very big commitment as it means that you owe hundred thousand Kenyan shillings to the lender and could take years to repay. Hence, here are some tips that can speed up the process of paying all the money owed back. Choose the right loan […]

Taking a loan in Kenya has been made easy in recent years, but don’t be in a rush to get a loan without carefully considering some major issues that determine whether you repay more or less. Interest rates Most people do put interest rates into consideration when they approach a […]

Acquiring a loan for a small business in Kenya is not an easy task. This is because banks are weary of the risks that small businesses are prone to compared to the large businesses. If you are considering borrowing a loan from a bank for your small business the best […]