A Quick Introduction to HELB

The higher education’s loan board commonly referred to as HELB is an loan disbursement department under the ministry of higher education which is charged with the mandate of providing students with financial assistance so as to make their life in campus more bearable and convenient through meeting the costs incurred while in school.

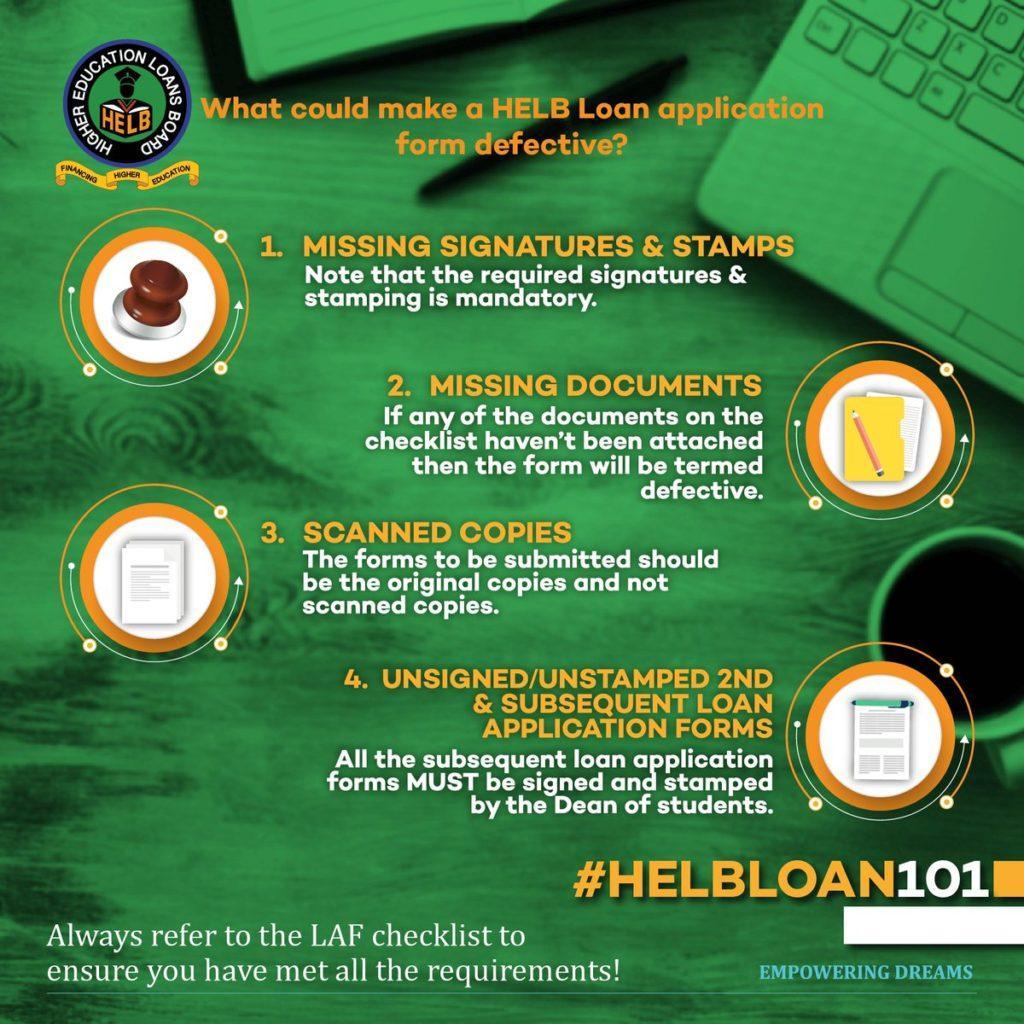

However, due to the fact that the government is disbursing the HELB to the students.There are a number of conditions which they are supposed to fulfill in order to get the funds, and also for the authorities to prioritize on the neediest students due to the large number of applicants with the loans board. Some of the requirements to qualify for the higher education loan include;

- One must have a Kenya Revenue Authority personal identification number (PIN),this is used to ensure that one has complied with the tax payments and clearance and also for future reasons for paying taxes. Once you have the KRA PIN one can then proceed to apply for the loan

- Approval and certification from the local leaders who have the understanding and a reflection of the financial ability of the family they include the chief and the pastor. It is believed they have the clear picture and the ability of the guardians or the parents to meet the tuition and upkeep of the student.

- The level of study one is at in the university and also whether it is a government sponsored or self-sponsored program. This helps in statistics and to ensure that there is a balance when making the financial allocation.

The role that is played by higher loans education board is very critical in ensuring the students have an easy and comfortable time in school without having to compromise their studies in a negative way by looking for jobs and having to miss their classes.

The government expects the loans beneficiary to pay back the monies once they seek employment and they start earning. These are attributed to a number of reasons such as to ensure that the higher loans department has more money to loan the incoming group of applicants and also for the government to recover their money. Due to the high risk nature of students not paying back the higher education loans the ministry has enacted tough penalties within its laws to ensure that the students compile and discourage any defaulters. The efficiency of the collecting the debt has been easier with automation of banking and also tax collection through iTax and other social services being offered by the government.

In addition to that, through the filling of returns by the employee the ministry of higher education in conjunction with ministry of treasury they withhold the monthly remittance to loans boards automatically through the check off system. This promotes accountability and maximum input to the system and also seal all the loopholes whereby former students can avoid paying back the loan to the higher education loans board. Especially due to the stiff penalties that come along with defaulting to pay the student’s loan.